Fabrinet (FN)·Q2 2026 Earnings Summary

Fabrinet Smashes Q2 Estimates as HPC Soars 5x to $86M, Fastest Growth Since IPO

February 2, 2026 · by Fintool AI Agent

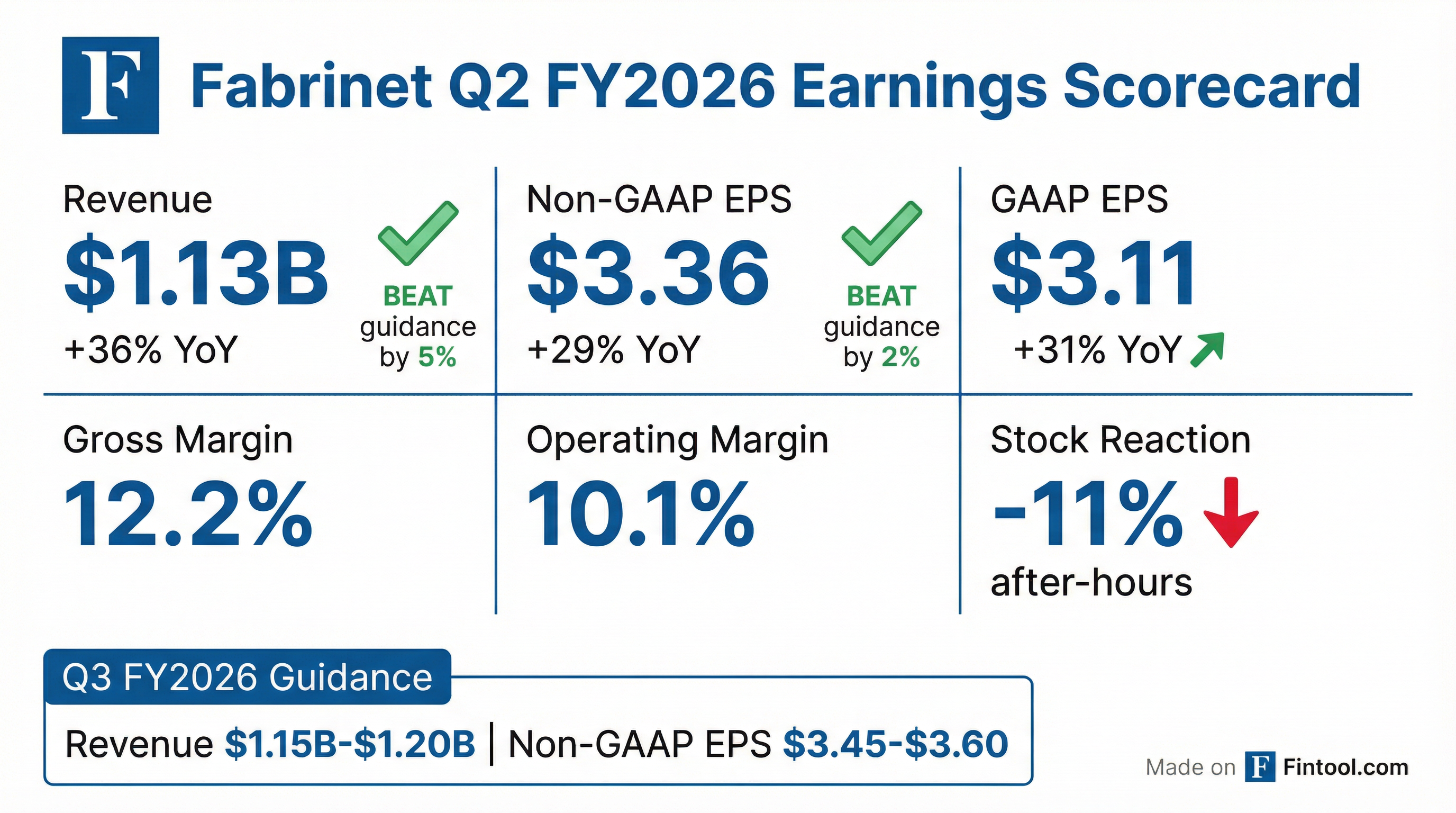

Fabrinet (FN) delivered another blowout quarter with record revenue of $1.13 billion (+36% YoY, the fastest growth since IPO) and Non-GAAP EPS of $3.36, both exceeding guidance ranges. The standout was HPC revenue exploding from $15M to $86M in a single quarter, with AWS confirmed as the customer. Management also revealed they're working on co-packaged optics with 3 different customers and expect hyperscale direct transceiver revenue "quarters away."

Did Fabrinet Beat Earnings?

Yes — decisively. Fabrinet beat on both revenue and earnings:

CEO Seamus Grady called it "an exceptional second quarter with record revenue and earnings that significantly exceeded our guidance ranges."

Beat/Miss Streak: Fabrinet has now beaten consensus estimates for 9 consecutive quarters on both revenue and EPS — one of the most consistent execution records in the tech sector.

*Values retrieved from S&P Global

What Did Management Guide?

Fabrinet issued strong Q3 FY2026 guidance that came in above consensus:

The guidance implies continued sequential growth of ~2-6% and year-over-year growth of ~38% at the midpoint.

Key growth drivers cited for Q3:

- Continued telecom momentum driven by DCI expansion

- Strong DataCom demand

- Rapid scaling of HPC program

Seamus Grady stated: "We are confident that the same drivers that helped produce these results will extend into the third quarter, as reflected in our strong guidance."

Revenue Breakdown by Segment

Optical Communications ($833M, +29% YoY, +11% QoQ)

Non-Optical Communications ($300M, +61% YoY, +30% QoQ)

Key Takeaway: HPC alone added $71M of sequential revenue growth, driving over half of the quarter's beat.

What Changed From Last Quarter?

Revenue Acceleration: Growth accelerated from 22% YoY in Q1 to 36% YoY in Q2 — the fastest year-over-year growth since Fabrinet's IPO over 15 years ago.

Operating leverage continues: Despite FX headwinds, gross margin improved 10 bps to 12.4%, and operating margin expanded 30 bps to 10.9% as revenue growth outpaced operating expense growth.

HPC ramp exceeding expectations: Revenue soared from $15M in Q1 to $86M in Q2 — a 5.7x increase. Management expects the program to reach >$150M run rate when fully ramped over the next 2 quarters.

Key Financial Trends (8 Quarters)

*Values retrieved from S&P Global

Takeaway: Revenue has compounded at ~55% over the trailing 8 quarters while maintaining gross margins in the 11.7%-12.4% range — a remarkable feat of operating discipline.

How Did the Stock React?

Regular Session (Pre-Earnings): +2.1% to $499.61

After Hours: Trading at ~$465.53, approximately -6.8% from the close

Despite the stellar results, the after-hours decline reflects:

- Profit-taking after massive run-up: FN has tripled from ~$150 in early 2024 to nearly $500 pre-earnings

- High bar already priced in: The beat, while strong, may not have exceeded the most aggressive expectations

- Valuation concerns: At ~25x forward earnings, any whiff of growth deceleration gets punished

- Typical "sell the news": After 9 consecutive beats, investors may be taking chips off the table

52-Week Range: $148.55 - $531.22 (currently near the upper end)

Balance Sheet Highlights

*Values based on prior quarter balance sheet

Notable: Inventory increased by $218M quarter-over-quarter, indicating the company is building inventory to support the continued rapid growth.

Cash Flow

Free cash flow is down year-over-year due to:

- Working capital investment to support growth (inventory build)

- Elevated CapEx for Building 10 construction

HPC Program Deep Dive

The High-Performance Computing business is rapidly becoming a major growth engine:

Current Status :

- Revenue: $86M in Q2 (up from $15M in Q1)

- Customer: AWS (confirmed in Q&A) — Fabrinet is currently a second source on the program

- Target run rate: >$150M when fully ramped over the next 2 quarters

- Production: 2 fully automated lines qualified, additional lines being qualified

Growth Paths :

- Expand share: If Fabrinet exceeds AWS expectations on cost, quality, and deliveries, they may earn a larger piece of the program

- New customers: Pursuing other HPC customers (relationship is not exclusive)

CEO Seamus Grady: "No matter how you look at it, we're very excited to see our high-performance computing business rapidly becoming a pretty meaningful revenue and growth driver."

Capacity Expansion Update

Building 10 (Chonburi Campus) :

Pinehurst Campus Conversion :

- Converting ~120,000 sq ft of office/warehouse space to manufacturing

- Revenue upside: >$150M capacity addition

- Timeline: Happening now (CEO "no longer has an office")

Future Runway: Room for Building 11 and Building 12 on same campus

CFO Csaba on downside risk: "The downside risk for us of building a factory that doesn't get consumed as quickly as we'd like is probably 15 basis points... The upside opportunity is huge."

Forward Catalysts

Near-term (Q3-Q4 FY2026):

- HPC full ramp: Targeting >$150M run rate over next 2 quarters

- DCI expansion: Strong demand for 400ZR and 800ZR modules continues

- Building 10 Phase 1: 250K sq ft ready by June 2026

- Datacom supply relief: Second source for EML laser approved, should benefit near-term

Longer-term:

- CPO (Co-packaged Optics): Working with 3 different customers on CPO programs — already seeing small revenue

- Optical Circuit Switching: Engaged on "a number of fronts" — significant future role expected

- Hyperscale direct transceivers: "Quarters away" from meaningful revenue

- New HPC customer wins: Pursuing additional hyperscale customers

Q&A Highlights

On Datacom supply constraints (Karl Ackerman, BNP Paribas):

- Demand continues to outstrip supply for 200G per lane products (800G and 1.6T)

- Second source for EML laser (the main bottleneck) was approved during the quarter

- "We are making good progress there... that supply constraint will resolve itself"

On CPO timeline (Samik Chatterjee, J.P. Morgan):

- Working with 3 different customers on co-packaged optics programs

- "Right now, it's much more real than it's ever been"

- "We believe we're far ahead of most of our competitors"

- Already seeing some (small) CPO revenue

On DCI vs. other Telecom growth (Mike Genovese, Rosenblatt):

- "DCI has been very strong for us. The growth is not just DCI, but it's predominantly DCI"

- Multiple customers driving growth (not just Ciena)

- Started ramping Ciena's new system program

On hyperscale direct opportunity (George Notter, Wolfe Research):

- "I would say we're quarters away. I don't think it's years away"

- Working on both merchant transceiver vendors and hyperscale direct

- Been working on this for 18+ months

On visibility (Mike Genovese, Rosenblatt):

- "We have more visibility now than we've ever had"

- Accelerating capacity buildout across all facilities

Risks and Concerns

- Valuation: Trading at premium multiples after massive run-up (tripled in 18 months)

- Customer concentration: Significant reliance on top DataCom customer and AWS HPC program

- Second source position: Currently second source on AWS HPC — must earn expansion

- FX headwinds: $3M revaluation loss in Q2; expect 20-30 bps gross margin headwind to persist

- Execution risk: Building 10 construction and multiple program ramps require flawless execution

- HPC lumpiness: "Two data points is not a trend" — growth won't be a straight line

Key Takeaways

- Fastest growth since IPO: 36% YoY revenue growth is the fastest in 15+ years

- HPC is the story: Jumped from $15M to $86M in one quarter; targeting >$150M run rate

- AWS revealed as HPC customer: Second source today, but opportunity to earn more share

- Guidance above consensus: Q3 midpoint implies ~35% YoY growth continues

- CPO becoming real: 3 customers, early revenue, "far ahead of competitors"

- Capacity buildout accelerating: Building 10 ahead of schedule, Pinehurst converting now

- Stock pullback context: -6.8% after hours despite beat reflects profit-taking after tripling